First-time home buyers in Alberta in 2025 can take advantage of multiple federal and provincial programs that make ownership more affordable. Key incentives include the First-Time Home Buyers’ Tax Credit, the Home Buyers’ Plan (HBP), and the First Home Savings Account (FHSA), which together can reduce upfront costs and save buyers thousands. New benefits such as a 5% GST rebate on new homes and the 30-year amortization option also improve affordability. Provincially, Alberta offers programs like Edmonton’s First Place Program and Calgary’s Attainable Homes. In this article, we’ll break down the top first-time home buyer incentives in Alberta for 2025, explain who qualifies, and show how Jenga Homes helps buyers maximize these opportunities when purchasing a new home.

What Federal Programs are Available for First-Time Home Buyers in Alberta in 2025?

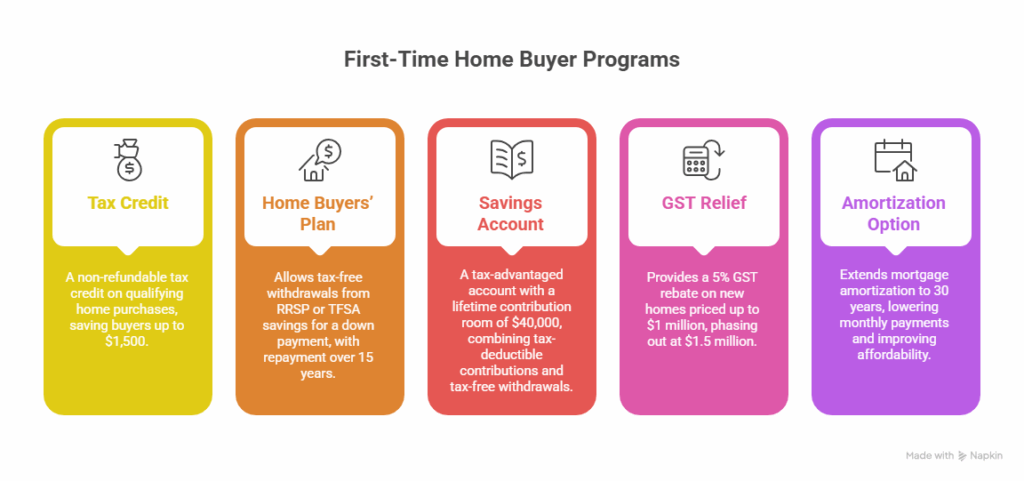

Several federal programs make up the core of first-time home buyer incentives in Alberta in 2025, helping reduce both upfront costs and long-term payments:

- First-Time Home Buyers’ Tax Credit – A non-refundable tax credit on up to $10,000 of qualifying home purchase, saving buyers up to $1,500.

- Home Buyers’ Plan (HBP) – Lets individuals withdraw up to $60,000 (or $120,000 per couple) tax-free from RRSP or TFSA savings for a down payment, with repayment over 15 years.

- First Home Savings Account (FHSA) – A tax-advantaged account with a lifetime contribution room of $40,000, combining tax-deductible contributions and tax-free withdrawals.

- GST Relief/Rebate – Introduced in 2025, this provides a 5% GST rebate on new homes priced up to $1 million, phasing out at $1.5 million.

- 30-Year Amortization Option – Extends mortgage amortization to 30 years for first-time buyers, lowering monthly payments and improving affordability.

These federal first-time buyer programs can collectively save Alberta homeowners tens of thousands of dollars when purchasing a new home.

Are there Provincial or City-level Incentives in Alberta in 2025?

Yes — beyond federal programs, there are several provincial and city-level first-time home buyer incentives in Alberta in 2025. These initiatives help lower upfront costs, reduce monthly payments, and provide tax advantages.

Provincial Incentives in Alberta

- Home Buyers’ Plan (HBP) – Withdraw up to $60,000 tax-free from RRSPs for a down payment, repayable over 15 years.

- First Home Savings Account (FHSA) – Save up to $40,000 lifetime with tax-deductible contributions and tax-free growth toward a first home.

- GST Rebate on New Homes – A 5% GST rebate applies to new homes up to $1M, phasing out at $1.5M.

- 30-Year Amortization Option – First-time buyers can reduce monthly payments by spreading their mortgage over 30 years.

Calgary Incentives

- The Home Program – Provides grants and education for eligible new buyers.

- First-Time Home Buyers’ Tax Credit – Up to $1,500 in non-refundable tax savings.

- City GST Rebate Eligibility – Rebates apply to qualifying new home purchases under $1M.

Edmonton Incentives

- First Place Program – Defers land costs for up to five years, making townhomes more affordable.

- First-Time Home Buyers’ Tax Credit – The same $1,500 federal tax credit applies to Edmonton buyers.

- GST/HST New Housing Rebates – Rebates typically passed through builders, reducing the cost of new homes.

Together, these provincial and municipal programs expand affordability, making 2025 one of the most supportive years yet for first-time buyers in Alberta’s major cities.

Who Qualifies for First-Time Home Buyer Incentives in Alberta in 2025?

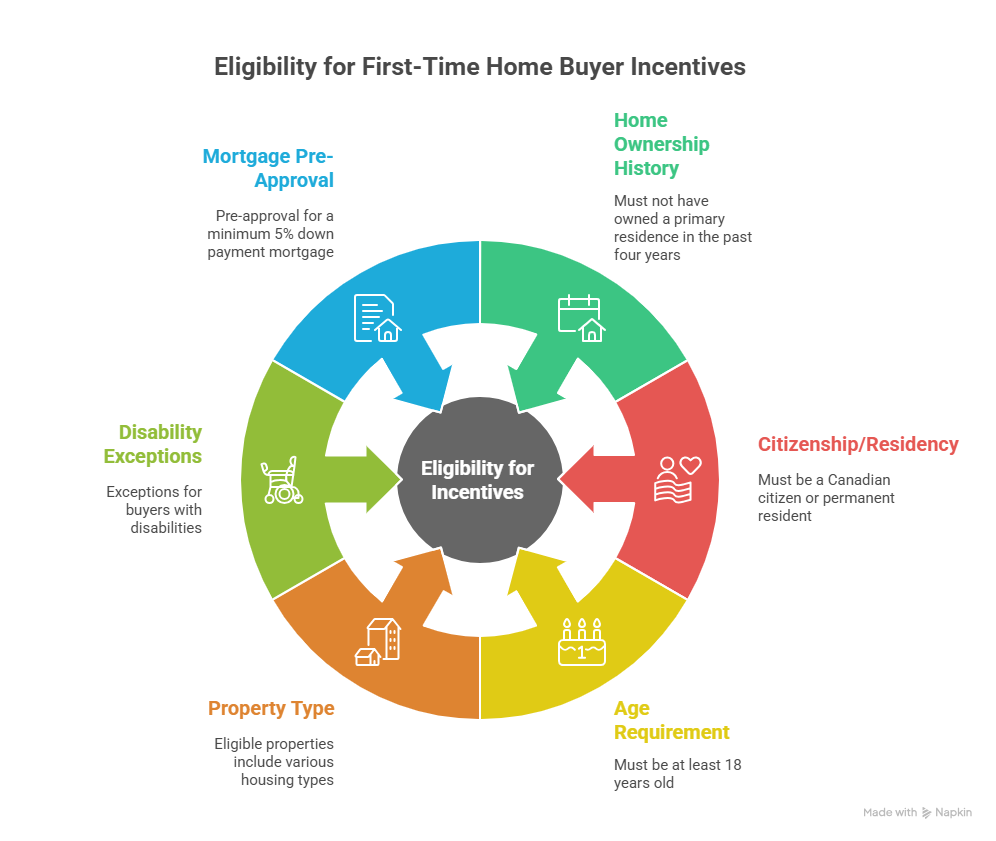

To access first-time home buyer incentives in Alberta in 2025, buyers must meet specific eligibility rules that apply across federal, provincial, and city-level programs.

General Eligibility Criteria

- Must not have owned and lived in a primary residence in the current or previous four calendar years.

- Must be a Canadian citizen or permanent resident and at least 18 years old.

- The purchased home must become the principal residence within one year of purchase.

- Eligible properties include houses, condos, townhouses, apartments, and mobile homes.

- Exceptions apply for buyers with disabilities or those purchasing for a person with a disability.

- Pre-approval for a minimum 5% down payment mortgage is usually required.

Alberta-Specific Requirements

- Some programs have income limits (e.g., Edmonton’s First Place Program requires household income below ~$117,000).

- Buyers must meet down payment requirements and purchase a qualifying property type under program rules.

City-Specific Eligibility

- Calgary – Must qualify as a first-time buyer and plan to live in the home. Incentives like the 30-year amortization and tax credits follow federal rules.

- Edmonton – The First Place Program adds net worth and mortgage pre-approval conditions, along with deferred land cost eligibility.

Overall, the key requirement is being a true first-time buyer (no homeownership in the past four years), meeting residency and financing conditions, and aligning with the property and income limits of each program.

How Does Jenga Homes Help Buyers Access Incentives?

Navigating the many first-time home buyer incentives in Alberta in 2025 can feel overwhelming, especially with both federal and city-level programs to consider. That’s where Jenga Homes makes the process easier.

Our team guides buyers through eligibility checks, mortgage pre-approvals, and the paperwork required for programs like the Home Buyers’ Plan, First Home Savings Account, GST rebate, and municipal incentives such as Attainable Homes Calgary or Edmonton’s First Place Program. We also connect clients with trusted financial partners to maximize tax credits and ensure incentives are applied directly toward lowering upfront costs and monthly payments.

By combining these incentives with our affordable, high-quality new homes in Calgary and High River, first-time buyers can stretch their budget further and step into homeownership with confidence.

👉 Call Jenga Homes on (403)-454-2218 today to learn how we can help you combine first-time buyer incentives with our new home options.

Quick FAQs for First-Time Buyers in Alberta

Q: How does the First-Time Home Buyer Incentive work in Alberta in 2025?

A: It provides shared equity support from the federal government, helping reduce monthly mortgage payments.

Q: What is the maximum RRSP withdrawal under the Home Buyers’ Plan in 2025?

A: Up to $60,000 per individual or $120,000 per couple, tax-free, for a home down payment.

Q: Who qualifies for first-time home buyer incentives in Alberta?

A: Canadians or permanent residents over 18 who haven’t owned a home in the past four years and plan to live in the new home.

In Conclusion...

In 2025, first-time home buyers in Alberta have more support than ever — from federal tax credits and RRSP withdrawals to city programs in Calgary and Edmonton. Together, these incentives can reduce upfront costs, lower monthly payments, and save buyers thousands. The key is understanding which programs you qualify for and how to combine them effectively.

At Jenga Homes, we help buyers navigate the full range of first-time home buyer incentives in Alberta in 2025 while offering affordable, high-quality new homes in Calgary and High River. Our goal is to make your first step into homeownership simple, stress-free, and financially smart.

👉 Contact Jenga Homes today to find out how you can apply these incentives to your new home purchase.