Okay, let’s be real. You’re picturing your first home in Alberta—a backyard, a kitchen you love, maybe even a mountain view. But when those interest rates hit (now averaging 5.3% for a five-year fixed mortgage and ranging from 3.9% to 6.5%), it feels like your dreams are getting priced out of reach.

You’re not alone—up to 60% of Albertans renewing mortgages are facing higher payments, with a quarter bracing for significant jumps in costs.

Still, Alberta stands out for first-time buyers. With average home prices hovering around $525,000 to $530,000—vastly more affordable than the national benchmark of roughly $700,000, and a fraction of what you’d pay in Toronto or Vancouver—buying your first place here isn’t just wishful thinking. There’s more inventory now, so you’ll find more options and less of that bidding-war stress.

Plus, programs like Canada’s First-Time Home Buyers’ Tax Credit (worth up to $1,500 back) and the low 5% minimum down payment for homes under $500,000 can make a real difference when you’re crunching those numbers.

In this post, we’ll show you why—despite those daunting mortgage rates—Alberta’s housing market could still be your best bet. We’ll break down how to tackle those payments, dig into what’s happening in Calgary, Edmonton, and smaller cities, and show you why Alberta home ownership is more within reach than you might think. Let’s dive in.

Alberta's Affordability Advantage

1. Lower Average Home Prices Compared to Other Provinces

Alright, let’s get to the part that really matters — your wallet. One of the biggest reasons first-time home buyers are turning their eyes to Alberta is simple: you get way more bang for your buck here.

Take a look at the numbers. The average home price in Alberta in mid-2025 is around $525,000 to $528,000, depending on the city, and that’s after some steady price growth this year. Compare that to Toronto, where the average home price soars over $830,000, or Vancouver, where it’s even higher — around $950,000 on average. That means for the same budget, you’re getting a much larger, more comfortable home in Alberta.

Focusing on Calgary and Edmonton — two of Alberta’s biggest markets — shows just how much more you get. In Calgary, the average home price hovers near $646,000, while Edmonton’s average is about $465,000. Those prices often get you a solid detached home or a townhouse with space for a yard, and maybe even the garage you’ve been dreaming about — something that feels nearly impossible in Vancouver or Toronto without breaking the bank.

This affordable housing Alberta factor is huge for first-time buyers trying to escape the rent cycle and start building equity. More options, less competition, and a balanced market make it an appealing place to get your foot in the door.

2. Diverse Housing Options

Okay, so it’s not just about price — Alberta’s housing market brings some serious variety to the table. Whether you’re dreaming of a modern downtown condo in vibrant Calgary or Edmonton, a cozy townhouse in family-friendly suburbs, or a spacious single-family home with a yard, Alberta’s got you covered.

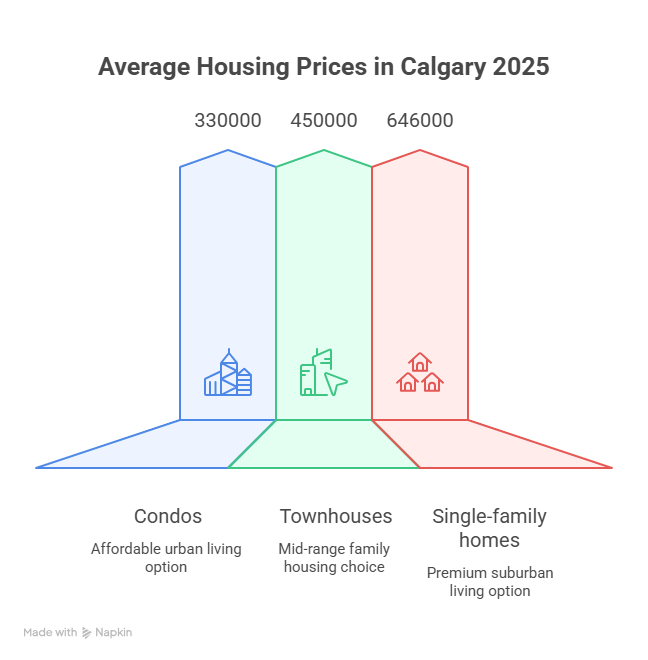

In Calgary, for example, condos make up about 30% of the market with average prices around $330,000, perfect for buyers looking to be close to the action without the huge price tag of bigger cities. Townhouses in the area average about $450,000, offering a great middle ground with more space and still affordable compared to many other urban centres. Single-family homes, meanwhile, average around $646,000, giving you the classic Alberta living experience with room to grow.

Over in Edmonton, the options are even more budget-friendly. Condos average roughly $280,000, townhouses come in around $375,000, and single-family homes hover near $465,000. That diversity means first-time buyers can pick a home style that fits not just their budget but also their lifestyle — from low-maintenance city living to family-focused neighbourhoods with parks and schools nearby.

This range of housing types makes Alberta especially attractive for first-time buyers who want flexibility. You’re not forced into one-size-fits-all. Instead, you have the freedom to find a home that really feels like yours — whether that means sleek urban vibes or quiet suburban comfort.

And just and FYI, at Jenga Homes, we specialize in building modern townhomes in up-and-coming Calgary neighborhoods, perfect for first-time buyers looking for style and affordability.

3. Slower Market Growth (Depending on Current Trends)

Alberta’s housing market in 2025 is notably more balanced and slower-growing compared to Canada’s overheated markets like Toronto and Vancouver, which can be a major advantage for first-time buyers. Instead of frantically jumping into bidding wars, buyers in Alberta often have more time to weigh their options, negotiate fair prices, and make thoughtful decisions without feeling pressured by rapid sales.

Recent data show that while average home prices in Alberta have increased moderately—about 4% year-over-year to around $528,000—the number of transactions has slowed by approximately 8% compared to last year, with sales dipping even more sharply in urban centers like Calgary, where volume dropped nearly 17% year-over-year. At the same time, new listings and inventory have grown by 10-18%, pushing Alberta into a more balanced market with a sales-to-new-listings ratio close to 60%, a key indicator that buyers are no longer competing in a frenzy for every property. This trend is reinforced by a months-of-supply metric rising to around 2.6 in Calgary, signaling less urgency and more choice for buyers.

Altogether, these factors create a calmer, less stressful environment for first-time buyers who want to take their time finding the right home, making Alberta’s market particularly buyer-friendly in an otherwise challenging national context.

Countering Interest Rate Concerns

Alright, the elephant in the room is that mortgage rates Alberta are not the most friendly. No one’s going to pretend they’re not a factor. But here’s the deal: don’t let those numbers completely derail your first-time home buyer dreams. There are ways to navigate this and here’s what to keep in mind;

1. Long-Term Investment Perspective

Yes, mortgage rates ebb and flow—sometimes up, sometimes down—and that’s just part of the game. But if you zoom out and look at Alberta real estate over the long haul, the picture looks promising. Despite some ups and downs, the average home price in Calgary has appreciated roughly 27% over the last 5 years, which is a steady gain compared to many other markets in Canada.

Even with short-term dips, investing in Alberta real estate means building equity in an asset that historically tends to grow in value over time. This long-term appreciation helps first-time buyers weather current higher interest rates because their home is likely to be worth more down the road. In other words, paying a bit more in interest today can be a price worth paying if you’re securing a solid, appreciating asset.

2. Strategies for Managing Interest Rates

Okay, so how do you actually deal with those mortgage rates Alberta? Here are a few smart moves:

1). Budgeting and Saving for a Larger Down Payment:

The more you put down upfront, the less you have to borrow, and the less you pay in interest. Start cutting back on those extra expenses and get serious about saving! This helps with affordability for first-time buyers.

Learn the best ways to prepare for a down payment here.

2). Explore Different Mortgage Options:

Don’t just settle for the first mortgage you see. Talk to a mortgage broker and check out different lenders. Consider:

- Fixed vs. Variable Rates: A fixed-rate mortgage gives you predictable payments, while a variable rate might be lower initially but can change. Weigh the pros and cons!

- Amortization Periods: A shorter amortization period means you’ll pay off your mortgage faster and pay less interest overall, but your monthly payments will be higher.

- Get pre-approved: Knowing how much you can borrow will give you a better idea of your budget.

These strategies can make home buying Alberta more manageable.

Download our Free Home Buyers Glossary here– it will help you understand the real estate lingo and avoid losses and miscommunication. Get it now, its FREE!

3). Find Government Incentive Programs

Good news! There are incentive programs designed to help first-time home buyers. These can include:

Federal programs:

- The Home Buyers’ Plan (HBP) allows first-time buyers to withdraw up to $35,000 (up from $25,000 recently) from their Registered Retirement Savings Plan (RRSP) tax-free to put toward a home purchase. This can provide a significant boost to your down payment, easing upfront costs.

- The First-Time Home Buyers’ GST/HST New Housing Rebate offers a rebate on a portion of the GST paid for a new or substantially renovated home valued up to $1.5 million, letting you save up to $50,000.

- The recently enhanced First Home Savings Account (FHSA) lets you save up to $10,000 per year, tax-free, specifically for your first home, combining the benefits of RRSP and TFSA accounts.

Explore federal programs here:

- Home Buyers’ Plan (HBP): https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan.html

- First-Time Home Buyers GST Rebate: https://www.canada.ca/en/department-finance/news/2025/05/gst-relief-for-first-time-home-buyers-on-new-homes-valued-up-to-15-million.html

- First Home Savings Account (FHSA): https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html

Provincial programs (Alberta):

- Alberta offers the Alberta First-Time Home Buyer Tax Credit, a non-refundable provincial tax credit of up to $2,000 to help with some of the costs of buying your first home.

- The Home Ownership Alberta Loan Program helps buyers with lower incomes by providing interest-free loans toward the down payment, making homeownership more accessible.

Further Alberta program info:

- Alberta First-Time Home Buyer Tax Credit: https://www.alberta.ca/first-time-home-buyer-tax-credit.aspx

- Home Ownership Alberta Loan Program: https://www.alberta.ca/homeownership-alberta-loan-program.aspx

It’s definitely worth doing your research to see if you qualify for any assistance. These programs can significantly ease the financial burden for first-time buyers and help turn your homeownership dream into reality.

- Learn how much you need to put down on a home in Alberta here

Why Now is Still a Good Time to Buy

So, we’ve talked about the challenges, but let’s get back to the positives. Even with those interest rates, there are some seriously compelling reasons why first-time home buyers should still be looking at Alberta real estate right now.

1. Building Equity vs. Renting

This is a classic, but it’s worth repeating: when you rent, you’re essentially paying someone else’s mortgage. You’re throwing money away each month that could be going towards your future. With Alberta home ownership, every mortgage payment you make builds equity. That means you’re increasing your ownership stake in an asset.

Think of it this way: instead of lining your landlord’s pockets, you’re investing in yourself. That equity can be a powerful tool down the road – for renovations, future investments, or even just financial security. For first-time buyers, it’s a way to start building wealth.

Read more about the considerations to make when deciding to rent of buy a home here.

2. Lifestyle and Stability

Okay, this isn’t about the numbers, but it’s HUGE. Owning a home gives you a sense of stability and control that renting just can’t match. You can finally paint the walls whatever color you want! You can put down roots in a community. You have a place that’s truly yours.

For first-time buyers, this can be a game-changer. It’s about creating a space where you feel comfortable, secure, and like you belong. And that’s priceless.

3. Future Appreciation Potential

Let’s be optimistic: Alberta has a strong track record of economic resilience, which often translates into solid real estate appreciation over time. While markets naturally fluctuate, the long-term trend here has generally been upward, supported by a diversified economy and steady population growth.

Take Calgary, for example. The city is benefiting from robust growth in key sectors like energy—fuelled by pipeline expansions and stable oil production—and a rapidly expanding technology industry that’s adding thousands of jobs. According to recent forecasts, Alberta’s real GDP is expected to grow by around 1.8% to 2.5% annually through 2025 and beyond, with economic drivers including the energy sector, technology investments, and continued interprovincial migration supporting housing demand. This economic momentum is a strong foundation for continued housing market strength and property value appreciation.

For first-time buyers, this means that purchasing a home in Alberta isn’t just about today; it’s about building equity in an asset likely to gain value in the years to come.

Steady population increases and new housing construction also add to long-term market stability, giving you a real shot at growing your investment as the province’s economy evolves.

Calgary Infill Development Opportunity for Home Buyers

One exciting opportunity for home buyers to consider in Calgary is the growing infill development market. Infill refers to the redevelopment of inner-city lots, often replacing older homes with modern, higher-value properties like custom single-family homes or “missing middle” housing types. In 2025, Calgary’s Infill Fast Track Program 2.0 is accelerating permits and approvals, making it faster and easier for buyers and builders to create or purchase these desirable properties in established neighborhoods.

For example, a 1950s bungalow in Killarney-Glengarry can be replaced by a modern infill home doubling in value within 18 months, highlighting strong appreciation potential.

This trend offers first-time buyers a chance to get into sought-after locations with updated homes, balancing urban living with more affordable prices compared to new suburban developments. The city’s strategic focus on urban densification and streamlined approvals is making infill one of the most dynamic segments in Calgary’s housing market this year.

To learn more about the infill development opportunity, click here.

In Conclusion...

If you’re a first-time home buyer feeling a bit overwhelmed, remember this: Alberta offers a unique blend of affordability, opportunity, and long-term potential. Yes, mortgage rates are a factor, but they don’t have to be a roadblock. By being informed, proactive, and strategic, you can achieve your dream of Alberta home ownership.

We believe that everyone deserves a place to call their own, and navigating the Alberta housing market doesn’t have to be a solo mission. To help you on your journey, we’ve created a FREE Glossary for New Homebuyers. It’s packed with all the essential terms and definitions you need to understand the process with confidence.

Download your FREE Glossary here

And when you’re ready to take the next step, we’re here to help! Whether you have questions about financing, finding the right neighborhood, or building your dream home, our team is dedicated to guiding first-time buyers every step of the way.

Contact us today for a free consultation and let’s make your homeownership goals a reality! Call us on (403)-454-2218 today 🙂